The recent news of Synnex’s acquisition of Westcon-Comstor’s American  operations, on the heels of Tech Data’s acquisition of Avnet’s Technology Solutions group, has many industry pundits asking about the future of value added distribution. As I mentioned in the Channel Partners article on the merger, there’s an upside and downside for partners regarding Synnex’s acquisition plans.

operations, on the heels of Tech Data’s acquisition of Avnet’s Technology Solutions group, has many industry pundits asking about the future of value added distribution. As I mentioned in the Channel Partners article on the merger, there’s an upside and downside for partners regarding Synnex’s acquisition plans.

The upside: Partners will get broader access to products under the Synnex roof. Synnex has primarily focused on server and storage business and Westcon has strength in security, unified communications and networking, bringing those together means the solution providers will have “one stop shopping” across more product lines. The downside: Consolidation among distributors means fewer to choose from and less competition for resellers’ business. This could affect the partners experience with distributors and ultimately the services and value the distributors are compelled to offer to the reseller ecosystem.

In our 2017 State of Partnering study, we examined how the vendors decisions around models, program and policies like the use of distributors affect the partners overall experience. Our premise is that the partners’ experience with a vendor determines the depth of engagement with that vendor. And engagement leads to sales. If a solution provider isn’t engaging with a vendors – either through their systems or their people, they aren’t likely selling a lot of that vendors’ products.

20% of the vendor respondents in the study don’t leverage two-tier distributors at all. They might be too small for the services of a broadline aggregator like Synnex or be delivering their solutions via the cloud and not need the physical warehousing and financing options of a distributor.

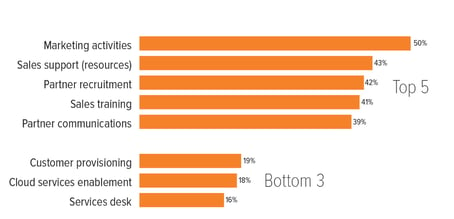

Of the 80% that do, the top five and bottom three leveraged areas were interesting (see graph). Though in the top position, it’s a widely known but rarely discussed secret that marketing activities through distributors do not return a lot of value. However the vendors seem to understand they must participa te in the distributors marketing campaigns to be allowed into other sales driving activities (like floor days). Marketing activities aside, the next three areas are the core value of distribution. We’re excited to see many of the vendor respondents agree that leaning on distributors to provide sales support, partner recruitment and sales training produces a significant ROI.

te in the distributors marketing campaigns to be allowed into other sales driving activities (like floor days). Marketing activities aside, the next three areas are the core value of distribution. We’re excited to see many of the vendor respondents agree that leaning on distributors to provide sales support, partner recruitment and sales training produces a significant ROI.

And while it’s not a shock to see cloud services activities among the bottom three activities, it is very disappointing to see Service Desk at the very bottom. If you follow our blog, you know we’ve had much discussion about the partners’ need for more access to services resources, methodologies and tools. It was the key theme throughout our 6 Pillars of Partner Experience report. Vendors could leverage distribution to help provide those key resources to partners.

The question of why Westcon was up for sale in the first place will continue to draw chatter for months to come. Was Westcon vulnerable after a failed SAP implementation? Are distributors struggling from a declining business as many vendors shift to cloud delivered products? Will we continue to see more consolidation in distribution as new solutions aggregators such as AWS and Azure launch marketplaces?

For distribution to stay relevant in the IT channel world, they will need to continue to morph the services they provide. As the industry moves to consuming technology as a service instead of through large capital expenditures in hardware and on-premise software, the distributor legacy value of warehousing, breaking pallets of products into individualized shipments, aggregating products into solution bundles and providing credit terms to resellers will become increasingly irrelevant.

The longer it takes traditional distributors to develop and deliver a value proposition for partners engaging in cloud delivered models, the more the door is open for other aggregators to step in and provide these services. We are already seeing cloud service aggregators engaging solution providers, consultants and system integrators into partner ecosystems. However these new aggregators are still clumsy in their approach to partnering. They do not as of yet have the experience, history or trust with channel partners.

We will be watching over the next 24 months to see if the remaining distributors can make the leap to design, develop and launch service offerings that are relevant to their reseller customer’s changing business models. Or, will the new cloud service aggregators learn how to engage and empower the solution provider ecosystem. The race is on.

Want more details on the growth of the channel in a cloud world? Get more data and more details in the State of Partnering report.