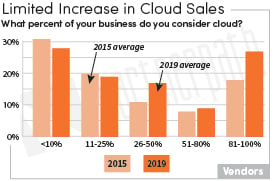

Vendors in our State of Partnering study corroborated IDC and Gartner predictions about increases in cloud revenues growing as a percentage of overall sales. However, when we removed the increasing number of vendors who are 100% SaaS or cloud-based, the lion’s share of vendor sales are still traditional on-premise solutions.

The vendor community is becoming increasingly bifurcated. A fourth of the vendor respondents (from our 2019 State of Partnering study) indicated they were nearly exclusively cloud while over 50% of them indicated they had less than a quarter of their business delivered via the cloud. More than a decade after the industry started talking about customers adopting on-demand models, vendors are still working on shifting products, business models and sales motions.

The vendor community is becoming increasingly bifurcated. A fourth of the vendor respondents (from our 2019 State of Partnering study) indicated they were nearly exclusively cloud while over 50% of them indicated they had less than a quarter of their business delivered via the cloud. More than a decade after the industry started talking about customers adopting on-demand models, vendors are still working on shifting products, business models and sales motions.

Are vendors engaging channels for growth?

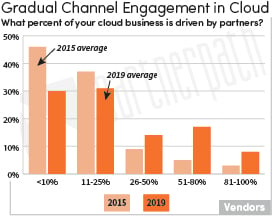

Vendors continue to struggle with an effective channel engagement model for their cloud business. The vendors aren’t selling much cloud, as compared to their overall business, and not much of that small amount is driven by their current channel partners. Since the first PartnerPath cloud study was released in 2015, we’ve seen an increase in both the amount of vendor business delivered via the cloud and the participation of solution provider partners in driving that cloud business. The trend is going in the right direction and in approximate alignment with IDC’s prediction of about 10% CAGR.

Vendors continue to struggle with an effective channel engagement model for their cloud business. The vendors aren’t selling much cloud, as compared to their overall business, and not much of that small amount is driven by their current channel partners. Since the first PartnerPath cloud study was released in 2015, we’ve seen an increase in both the amount of vendor business delivered via the cloud and the participation of solution provider partners in driving that cloud business. The trend is going in the right direction and in approximate alignment with IDC’s prediction of about 10% CAGR.

But the question remains whether cloud adoption can accelerate by 2022 to surpass spending on non-cloud IT infrastructure as predicted by IDC. That’s a big leap from where most technology vendors are now. We would assert this growth cannot be achieved without the channel. Or more specifically, not without a channel. The vendors responding to this survey are just beginning to add new types of partners to their ecosystems. Legacy solution providers currently filling the technology vendor channel ranks might not be the businesses to drive widespread cloud solution adoption.

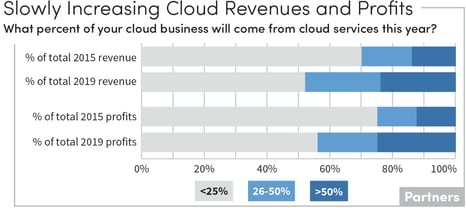

The percentage of solution providers indicating more than half of their revenues and profit coming from cloud has nearly doubled since 2015. This is encouraging and exciting! However, this is still less than 15% of the solution provider respondents. Yes, cloud revenues and profitability are increasing for these solution providers, just not very fast. And certainly not as fast as IDC and Gartner predict the overall growth of cloud computing models.

The percentage of solution providers indicating more than half of their revenues and profit coming from cloud has nearly doubled since 2015. This is encouraging and exciting! However, this is still less than 15% of the solution provider respondents. Yes, cloud revenues and profitability are increasing for these solution providers, just not very fast. And certainly not as fast as IDC and Gartner predict the overall growth of cloud computing models.

If these solution providers aren’t contributing to the growth of the sector, who is? There is a new breed of solution provider emerging that drive more cloud business than the traditional channel partners who are struggling to transition to cloud models (who participate in vendor programs and thus are included in our studies).

What are threats to solution providers?

Direct vendor competition is the primary threat to the majority of the solution providers’ business. Peer competition and lack of available talent round out the top three threats they see to their business in 2019. This is a subtle change from years past when available talent was a more significant concern than their peer competition. Highlighting both direct competition and peer competition as top threats, even more than finding and keeping talent, is a bit alarming in the US economy which has the lowest unemployment rate in four decades. Competition must really be on their minds.

As solution providers become micro-specialized to meet their customers’ expectations, we anticipate increased differentiation which will reduce the threat of peer competition. It’s a bit surprising cloud self-service doesn’t seem to worry the solution provider respondents, as it was ranked near the bottom of their concerns as a threat to their businesses. The solution providers clearly see they have a role in cloud.

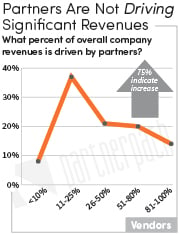

The solution providers may have a valid point in their concerns about direct vendor competition. Knowing that less than 50% of the vendors’ cloud business is being driven by partners, this lack of influence in driving sales also holds true across the vendors’ overall business. A measly one-third of the vendor respondents indicate more than 50% of their overall revenues are driven by partners. Most of the vendors surveyed have upwards of 50% of their sales transacted through partners, but when we change the question to percentage of revenues driven by partners, the median response falls to the 26-50% range.

The solution providers may have a valid point in their concerns about direct vendor competition. Knowing that less than 50% of the vendors’ cloud business is being driven by partners, this lack of influence in driving sales also holds true across the vendors’ overall business. A measly one-third of the vendor respondents indicate more than 50% of their overall revenues are driven by partners. Most of the vendors surveyed have upwards of 50% of their sales transacted through partners, but when we change the question to percentage of revenues driven by partners, the median response falls to the 26-50% range.

The good news is a whopping 75% of the vendors indicated their partner-driven revenues will increase in 2019. A scant 2% said their partner revenues would decrease. This points to vendors becoming increasingly reliant on partners to create full solutions that address customer needs.

What to Do: Remove Roadblocks to Cloud Success

|

This blog is an excerpt from the PartnerPath 2019 State of Partnering report: Driving Cloud Adoption. More excerpts will be published in coming months. Be sure to subscribe to our blog below!