How have the solution provider sales changed?

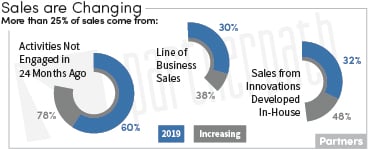

The vendors* changing the role they expect partners play in cloud offerings aligns with the solution providers’ indication of their changing sales. 60% of respondents indicated they’re generating more than a quarter of their sales from activities they weren’t engaged in 24 months ago. That’s nearly double the number from the 2015 report. And 75% of the solution providers indicated this would increase in the coming years. Not surprisingly, more than 40% of the solution providers indicated those new sales activities were focused on the high gross margin managed service offerings.

The vendors* changing the role they expect partners play in cloud offerings aligns with the solution providers’ indication of their changing sales. 60% of respondents indicated they’re generating more than a quarter of their sales from activities they weren’t engaged in 24 months ago. That’s nearly double the number from the 2015 report. And 75% of the solution providers indicated this would increase in the coming years. Not surprisingly, more than 40% of the solution providers indicated those new sales activities were focused on the high gross margin managed service offerings.

30% of solution provider respondents indicated they are getting a quarter of their sales from line-of-business buyers and only 35% say they’re likely to increase sales in this area. This is not enough. Jay McBain, Principal Analyst of Global Channels at Forrester, cites that 65% of technology decisions are now made by business leaders. Yes, it’s a big investment for solution providers to hire and train marketing and sales people to develop strong value propositions to a line-of-business owner. But the solution provider ecosystem must move faster.

32% of solution provider respondents also indicated they’re getting a quarter of their sales from innovations developed in-house, with nearly 50% saying this will increase in coming years. This aligns with Canalys’ assessment that 55% of partners develop their own applications and with Cisco’s huge investment in DevNet – a source for APIs, SDKs, Sandbox and community to help solution providers write applications and develop integrations with Cisco products.

Are vendors effectively compensating for sales roles?

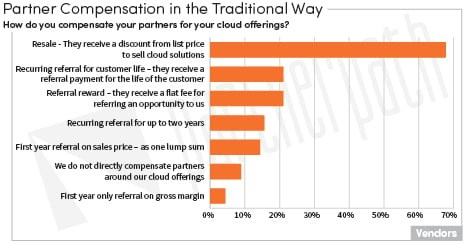

The vendors’ method of compensation aligns with the reselling role they want the solution providers to play. Nearly 70% of the vendor respondents compensate partners for cloud offerings in a traditional resale way. The partners receive a discount from list price to sell cloud solutions. We primarily see this as a discount on seat licenses. If the list price is $20 per license (or terabyte or compute hour) the vendor typically provides a 20-30% discount to the partners, meaning they purchase it for $16 a seat. Unfortunately, partners rarely sell at list price. They probably sell it at $18 a seat and make $4 per license per month on that product. Therefore, we see cloud resale fairly low in the ranking of partner gross profit margin. With all the talk about encouraging partners to look past the sale and on to customer usage, adoption, growth and renewal of their cloud systems, it is short-sighted for vendors to prefer to pay partners a discount for selling the product. Admittedly, it is very difficult to change compensation models – both for an established partner ecosystem and for a field sales team. But it must be done.

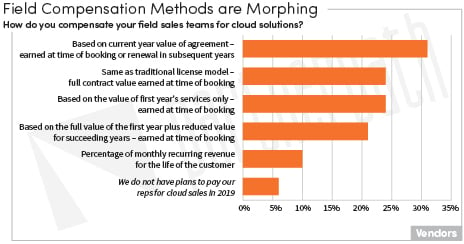

Surprisingly, vendor field compensation is morphing a bit from the same ‘as a traditional resale model’ they leverage for partners we saw four years ago. The vendor responses are dispersed across the compensation model options, indicating they’re trying different models out on the field teams. Less than a quarter of the vendor respondents pay their own field sales people for cloud solutions in the traditional resale way – as full contract value earned at the time of booking. Rather, a third of them compensate their field teams in a slightly more cloud-oriented model – based on the current-year value of the agreement, earned at the time of booking or renewal. Only a small handful of the vendors pay their field teams for the life of the customer – wouldn’t that be nice to be paid every quarter for a customer you sold once! Just over 20% of those same vendors pay the solution provider that way – a recurring referral fee for the life of the customer. Most likely, the referral fee percentage decreases over time but the incentive for the partner to continue creating a satisfied customer remains.

Surprisingly, vendor field compensation is morphing a bit from the same ‘as a traditional resale model’ they leverage for partners we saw four years ago. The vendor responses are dispersed across the compensation model options, indicating they’re trying different models out on the field teams. Less than a quarter of the vendor respondents pay their own field sales people for cloud solutions in the traditional resale way – as full contract value earned at the time of booking. Rather, a third of them compensate their field teams in a slightly more cloud-oriented model – based on the current-year value of the agreement, earned at the time of booking or renewal. Only a small handful of the vendors pay their field teams for the life of the customer – wouldn’t that be nice to be paid every quarter for a customer you sold once! Just over 20% of those same vendors pay the solution provider that way – a recurring referral fee for the life of the customer. Most likely, the referral fee percentage decreases over time but the incentive for the partner to continue creating a satisfied customer remains.

What to Do: Link Compensation to Behaviors

|

*This blog is an excerpt from the PartnerPath 2019 State of Partnering report: Driving Cloud Adoption using data gathered from 100+ vendors and 200+ partners in our annual State of Partnering study. More excerpts will be published in coming months. Be sure to subscribe to our blog below!

*This blog is an excerpt from the PartnerPath 2019 State of Partnering report: Driving Cloud Adoption using data gathered from 100+ vendors and 200+ partners in our annual State of Partnering study. More excerpts will be published in coming months. Be sure to subscribe to our blog below!