The Roles of Enablement, Spending and Distribution in a Cloud Sales World

Does enablement ever end?

Enablement is a key tenet to partner success. Both the vendors* and the solution providers* want to invest in enablement. The better trained a partner is the more they design effective solutions to customer needs, produce differentiated marketing campaigns, accurately position the products and troubleshoot issues. Enablement is really a win-win for all sides – vendor, partner and customer.

Enablement is a key tenet to partner success. Both the vendors* and the solution providers* want to invest in enablement. The better trained a partner is the more they design effective solutions to customer needs, produce differentiated marketing campaigns, accurately position the products and troubleshoot issues. Enablement is really a win-win for all sides – vendor, partner and customer.

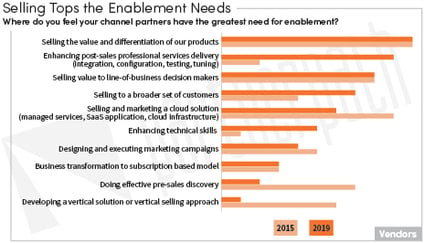

The vendor respondents* continuously rank selling the value and differentiation of products as the greatest need for solution provider enablement. This is not to say that selling and marketing cloud solutions are not important to the vendor community. On the contrary, cloud solution sales continue to grow as an overall percentage of the vendor’s total sales. However, the core capability of understanding a product and solution’s value to the customer – how those products might lead to business outcomes for customers – is what vendors are consistently concerned with.

A big shift from our past findings is how vendors are re-focusing enablement on activities that enhance partners’ post-sales professional services delivery – including integration, configuration, testing and tuning. Cloud products aren’t deployed as a one-off – they are typically integrated with other products and services into a full solution. Vendors realize solution providers need to be able to successfully provide post-sales services to ensure product adoption, usage and customer success.

The vendor community has shifted from enablement being viewed as an end-game, where a partner is enabled when they can accurately sell and successfully implement products, to an ongoing activity. Yay! It’s been a long time coming! Enablement no longer means “just” technical skills and certifications. Long gone are the days when a partner hits a threshold and you say, “Voila! They are enabled!” (if you ever could). Now, just when we think the partners are self-sufficient, new needs like business transformation to a cloud model, partner-to-partner facilitation or talent acquisition come along. This often means everyone at the vendor is in some part responsible for some enablement activity. It takes a whole company to continue to empower partners for increased success.

What are vendors spending across incentives?

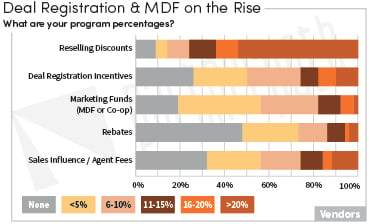

Due to the complexity and variety of products sold, business models, vertical industry focus, services capabilities and geographic reach, we can rarely reliably aggregate partner margin data. But we did ask the vendors for their program compensation ranges. It is always interesting to see the wide ranges across these incentives – and they should be examined only in the context of an overall combined financial model. For example, some vendors may have a low discount and high deal registration incentives. Others might have high product discounts and offer very little in the way of deal registration, co-marketing funds or rebates. Put all the pieces together instead of evaluating each individual element.

Due to the complexity and variety of products sold, business models, vertical industry focus, services capabilities and geographic reach, we can rarely reliably aggregate partner margin data. But we did ask the vendors for their program compensation ranges. It is always interesting to see the wide ranges across these incentives – and they should be examined only in the context of an overall combined financial model. For example, some vendors may have a low discount and high deal registration incentives. Others might have high product discounts and offer very little in the way of deal registration, co-marketing funds or rebates. Put all the pieces together instead of evaluating each individual element.

Reselling discounts were diverse across the vendor respondents with the average in the greater than 20% range. We’ve seen resale discounts increase since the 2015 study as vendors look to bolster solution provider profitability and thus the motivation for selling cloud solutions.

Deal registration incentives averaged in the 11-15% range again this year. This has been consistent for the past six years. The vendors reported deal registration percentages were one of the two elements expected to increase in 2019. This points to emphasizing partner rewards for driving the sale versus simply fulfilling an order.

Influencer/agent fees, rebates and MDF averaged in the 6-10% range this year. This is an increase in MDF spending over previous years. With the vendors focused on helping partners spin up digital marketing capabilities, we're excited to see more spend on marketing activities. The vendor respondents did report they were expecting to increase MDF program percentages in 2019. Let’s hope they followed through and secured these additional funds!

Where to leverage distribution in a cloud world?

Partners need a lot of support to operate cloud business models. 80% of the solution provider respondents leverage distributors or master agents to support their cloud business – mostly for enablement and support resources. The top solution provider responses were: sales support, tech support, technology sales resources, technical training and sales training.

Partners need a lot of support to operate cloud business models. 80% of the solution provider respondents leverage distributors or master agents to support their cloud business – mostly for enablement and support resources. The top solution provider responses were: sales support, tech support, technology sales resources, technical training and sales training.

70% of the vendor respondents leverage distributors and/or master agents to help execute many of their program elements. However, there is a disconnect between how the solution provider respondents indicate they leverage distribution/master agents and what the vendors report. Sales training was the only element included in the top five elements for both solution providers and vendors. Vendors focus distribution on recruiting new partners, marketing, communications and credit/finance. If distribution is a middleman to amplify the vendors' offerings to solution providers, shouldn’t both sides be leveraging them for the same activities?

Only a handful of vendors are leveraging distribution to support key activities in cloud such as solution aggregation, customer billing, provisioning, managing licensing renewals and cloud services enablement. These are services solution providers need as they move to a cloud business and about 20% of the solution providers reported leveraging distributors or master agents for these elements. However, as the traditional broadline distributors are struggling to offer these crucial elements, solution providers are engaging with non-traditional partners to source these business essentials. The solution providers are getting these services from somewhere! Distributors have decades of deep relationships with solution providers and are the de facto source to extend the support vendors can’t offer partners at scale. If distributors don’t quickly invest in ramping up these cloud capabilities to their solution provider customers, they will find their core base of partners, those less than $50m in yearly revenues, creating partnerships with other service bureaus that can provide what they need to operate in the cloud. This could diminish the value of distribution to solution providers and put the traditional two-tier channels at risk.

What to Do: Focus on Partner ROI

|

*This blog is an excerpt from the PartnerPath 2019 State of Partnering report: Driving Cloud Adoption using data gathered from 100+ vendors and 200+ partners in our annual State of Partnering study. More excerpts will be published in coming months. Be sure to subscribe to our blog below!

*This blog is an excerpt from the PartnerPath 2019 State of Partnering report: Driving Cloud Adoption using data gathered from 100+ vendors and 200+ partners in our annual State of Partnering study. More excerpts will be published in coming months. Be sure to subscribe to our blog below!