Channel partners act as trusted advisors for their customers.

Gone are the days of partners purchasing products from vendors or distributors, warehousing those products, configuring the solution and installing it on the customer’s site. Yes, some products are still delivered in this manner and some solution providers are still making a very good living as resellers. However, as we look to where the industry and channel ecosystem are going – this model doesn’t have long before it is obsolete. Partners are becoming trusted advisors and also taking on more cloud roles.

This trend has been progressing since we started evaluating channel models back in 2005 and points us where we need to be headed. In 2006, we noted managed services were becoming an important channel model and MSPs started appearing in the vendor ecosystems – like Oli Thordarson at Alvaka Networks, who had already been offering managed services for a decade. Five years later, vendor cloud programs started to emerge. Most of these were separate initiatives, often side-programs for a product group or division, such as Microsoft’s Cloud Accelerator program launched in 2010.

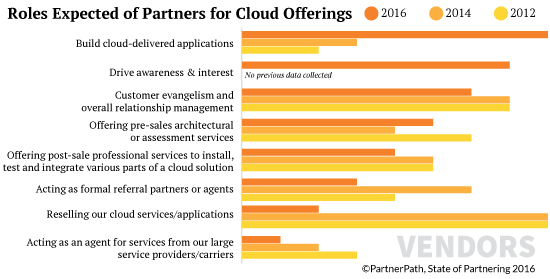

According to our annual State of Partnering survey, for the last three years, vendor respondents were very consistent on the role they expected partners to play in cloud offerings. They wanted solution providers to resell cloud services, followed by customer evangelism and acting as a formal referral partner (sales). But vendor respondents from this year’s study indicated the primary role they want partners to play in the cloud is first and foremost to build and deliver applications. Then followed driving awareness and interest (marketing) and then customer evangelism.

This is a significant and exciting shift predicting the big change to come: reselling will go away. In its place, channel partners will become more significant trusted advisors for their customers, providing consulting and insights on technology-based solutions to drive business opportunities and challenges.

The channel will still bundle products into solutions, so there will be partners who purchase products from vendors and resell those products. But now this resale motion will be a part of the partner’s branded solution. For example, even though Intellinet is a Microsoft centric firm, they promote their suite of services: productivity, digital marketing, business intelligence, sales enablement and HR processes – without mentioning the Microsoft products behind those offerings. The primary roles of reselling, pre-sales architecture and procurement/billing that top the priorities for vendor respondents’ traditional business models will give way to more marketing, sales and customer satisfaction functions imperative in a cloud model.

Define the channel’s role in cloud offerings.

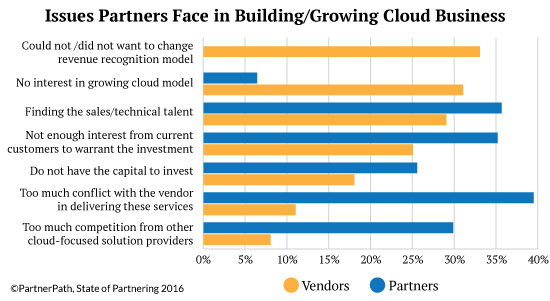

While there is clearly growth and commitment to continued investment by vendors and solution providers, there was a disconnect in the survey responses about the roadblocks to increased cloud success. When we asked vendors what issues their partners’ experienced in building a more cloud-centric business in 2015, their top two responses were related to the partners’ ability or unwillingness to shift their business model. A combined 64% of vendor respondents indicated partners either “could/did not want to change their revenue recognition model” and/or “did not believe a cloud model was right for them.” However, only 7% of solution providers indicated they weren’t interested in growing their cloud revenue, meaning it wasn’t the right model for them.

Particularly disheartening though was the misalignment with the top solution provider response to the same question: “What issues have you faced when trying to grow your cloud business?” By far, the most popular answer from solution provider respondents was “competition from the manufacturers/vendors offering the services directly.” Almost 40% of solution providers felt their primary issue in growing their cloud revenues was vendor conflict but only 11% of the vendors felt this was a top concern.

What does this huge disconnect indicate? We are adamant it is evidence that vendors are hanging on to the traditional resale model for the channel. High levels of conflict reported by the solution providers indicate the vendors haven’t yet embraced the partner ecosystem as a route-to-market for their cloud solutions (many are figuring out how to sell and support cloud offerings themselves). In a 2020 model, resale will be an irrelevant portion of the business, so we’d better all figure out a model to effectively engage and enable third party companies (partners) for shared success.

This is an excerpt from one of our 10 Trends for a 2020 Vision in the 2016 State of Partnering Report. Keep following our blog for more posts and invitation to join webinar discussions.